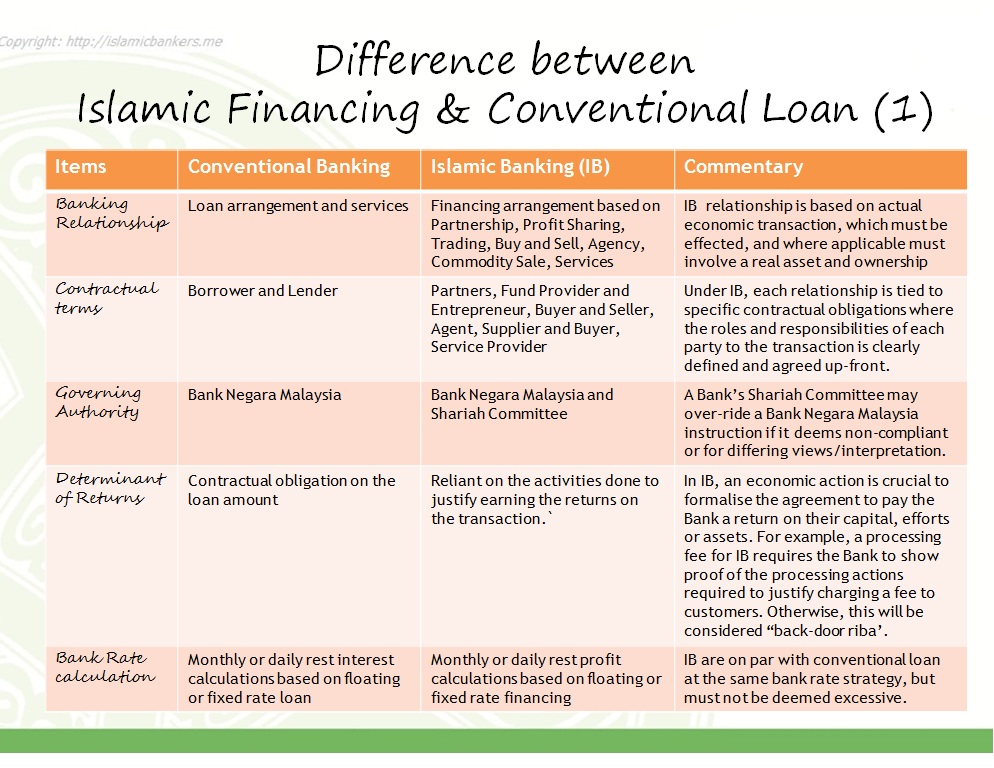

Islamic vs Conventional Banking. Islamic scholars issued a fatwa stating they had no objection to the use of the term interest in loan contracts for purposes of tax avoidance provided the transaction did not actually involve riba and the Islamic bankers used the term for fear that lack of tax deductions available for interest but not profit would put them at a competitive disadvantage to conventional banks.

Islamic Finance Is Not More Expensive Than Conventional Home Loans

Earlier the ministry had put the number of people killed at 32 but a further ministry statement brought the number down to 29 including six children and four women.

. On July 28 US Securities and Exchange Commission SEC Chair Gary Gensler released a video outlining how the SEC will. And elimination of glaring inequalities in personal income and wealth. The maximum loan amount provided is AED 4000000 for UAE nationals and AED 2000000 for expats.

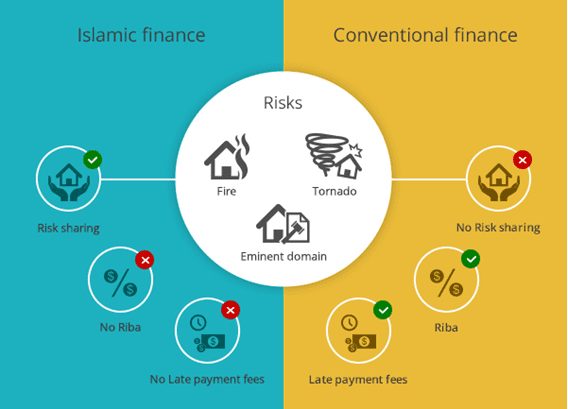

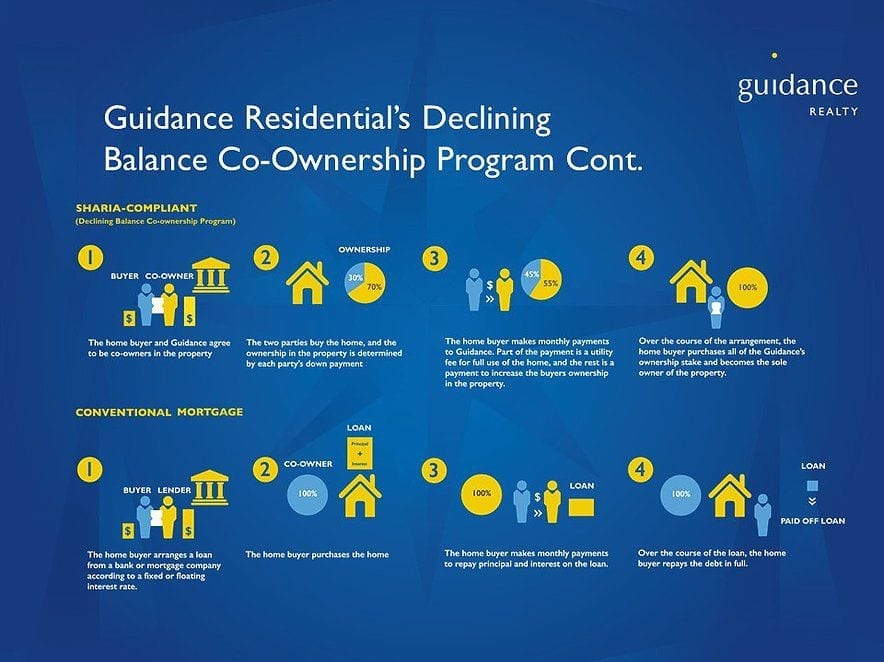

Criticsskeptics complainnote that in practice most murabaḥah transactions are merely cash-flows between banks brokers and borrowers with no buying or selling of commodities. That the profit or markup is based on the prevailing interest rate used in haram lending by the non-Muslim world. Whats the difference.

Voda Idea Prepays 27kcr Loan to SBI Loss-making Vodafone Idea Vi has prepaid a short-term loan of about 2700 crore to SBI in a bid to shore up lenders confidence as it urgently seeks fresh bank funds to tie up equipment supply deals for 5G networks and also clear some of its near 15000-crore trade payables comprising dues to tower companies network gear. Soon she started getting repeat orders from her growing clientele so much so that she was able to pay back the loan to the Bank before the due time. Zakat also acts as an excellent form of social insurance.

That the financial outlook of Islamic murabaha financing and conventional debtloan. Mostly they are based on sale and purchase transactions accompanied by a degree of risk. Check out the latest promos from official Hyundai dealers in the Philippines.

Personal loans offered by DIB will help you meet your financial requirements in a Shariah-compliant manner. KIBOR is Karachi Inter Bank Offer Rate given by State Bank of Pakistan on daily weekly monthly and on 1 2 and 3 yearly basis to all commercial banks of Pakistan so that they may charge interest to their customers on that basis. Qard hasan is a Quranic term meaning an interest-free loan.

The second loan was also of PKR 40000 and with it she was able to hire a part-time. ABL Self Service Branch at LUMS. List of Clearing Branches.

The SPDR STI ETF has been around for longer 2002 vs 2009 and its fund size is also much larger 1700m vs 496m indicating that its more popular. With the first successful experience Sadaf decided to take another loan to expand the tailoring business. The Hyundai Kona has a front-engine front-wheel-drive layout with the power coming from a 20-Liter MPI Nu Atkinson cycle gasoline engine that produces 147 hp and 179 Nm of torque.

FREE Takaful Coverage for Islamic Account and Debit Card Holders. For Islamic banks to a make profit and to satisfy the borrowers needs of cash they have to conduct transactions that do not violate Islamic rules by looking for allowed contracts that can achieve the required goal. Front suspension is a McPherson strut setup while the rear end gets a coupled torsion beam axle.

Interest rates for housing loans in Malaysia are usually quoted as a percentage below the Base Rate BR. As of 2nd January 2015 Base Lending Rate BLR has been updated to Base Rate BR to reflect the recent changes made by Bank Negara Malaysia and subsequently by major local banks the interest rate on a BR. The engine is mated to a conventional 6-speed automatic transmission.

Allied Aitebar Khanum Services. Allied Car Finance offers car loan facility on low and affordable markup rates of up to 1 Year KIBOR 4. Due to its age and size the SPDR STI ETF also tracks the STI.

Discover the 2022 Hyundai Accent. Allied Aitebar Khanum Account. Features of Dubai Islamic Personal Loan.

A guarantee of the fulfilment of basic needs. After all they still need to be sure you can afford your monthly repayments during the term of your loan. There are five main contracts in Islamic finance.

Maximum tenure provided for both UAE nationals and expats on DIB loan is 48 months. The death toll from violence in Gaza has risen to 29 including six children the health ministry in the Palestinian enclave said Sunday correcting a previous statement. In the same way that conventional lenders carry out checks on your credit history when you apply for a mortgage Islamic banks will follow the same guidelines.

Find specs price lists reviews. The Islamic view of distributive justice is contained in the three points. For example if the current BR rate is 400 Update.

The Difference Between Islamic Banking Financing And Conventional Banking Loans Islamic Bankers Resource Centre

Islamic Vs Conventional Banks In The Gcc Blogs Televisory

Differences Between Conventional Banks And Islamic Banks Download Scientific Diagram

0 Comments